One of the most frequent questions I get on Twitter/X is: “Which investment platform do you use?”

I don’t really know why people ask this in a world where the excellent Monevator comparison table exists.

Disclosure: Links to platforms may be affiliate links, where we may earn a small commission. It doesn’t affect the price you pay nor how we judge the brokers.

However there are a few real-world issues that are out-of-scope for the table’s aggregated roundup.

So today I’m going to treat you to a tour of every investment platform (or ‘broker’) that I use and why.

Disclaimer: I will be stating my opinion based on experience. I do acknowledge though that I may have made mistakes, been misled, or that I could be confused about things. I’m happy to be corrected in the comments. None of this article is a recommendation to use (or a recommendation not to use) any particular investment platform. Brokers are also welcome to DM me for clarification. Especially if it means they’ll sort out some of the things I’m complaining about.

Behind the scenes at the Finumus family office

First off, why do we use more than one platform?

There are a few reasons:

No one platform does everything we want

We don’t want all our eggs in one basket:

Yes, I know, there’s the FSCS. But it’s capped at an only moderately useful £85,000

Yeah, I know, assets are held in segregated client accounts1 Well, sorry – I used to work in this industry and I don’t trust it

I’ll only be discussing platforms that I have direct experience of using on a fairly frequent basis. These are:

IWeb (essentially the same as Halifax Share Dealing)

IG

X-O (part of Jarvis)

Interactive Brokers

Yes, that’s quite a lot of platforms. There used to be even more! Platforms we’ve previously used but that we no longer do include:

iDealing

Barclays

Charles Stanley

I’ll let the reader draw their own conclusions from my change of heart.

Finally, when I say “we” I mean the Finumus ‘micro family office’. This is a portfolio of ISAs, SIPPs, and so on that I nominally manage holistically across three generations of our family, along with our Family Investment Company (‘FIC’).

Family linkage

Our micro family office set-up raises the first feature we like to see – some sort of ‘family linkage’ capability.

Both Hargreaves Lansdown and AJ Bell make a reasonable go at this. Account holders can nominate another account holder to manage the investments in their account. The managing account can then log in as themselves and flip to the other person’s account – without needing to share credentials – and without access to payment capabilities.

This is very useful to me for looking after the accounts of parents and children in a secure way.

Good as it is though, the family linkage is slightly hobbled. A prime example is that you can’t take any of the so-called Appropriateness Tests for things like complex products by proxy. Which is particularly annoying when you’re trying to rebalance into something that the investment platform has arbitrarily decided is ‘complex’.

You’re left having to phone Grandma to talk her through the test. If she’s on a six-week cruise at the time you can forget about it.

However, even when hobbled, these options are much preferable to those investment platforms that don’t offer this facility at all – which is every other one on my list.

Whatever the platforms’ reasoning for the lack of any family linkage, in the real world it leaves you having to insecurely share credentials – which is far from ideal – and in some cases having to call family members for a 2FA code every time you want to login.

Investment platform costs

We are less bothered about annual platform costs than we are that they should not scale with our AUM2.

So we like fixed or capped costs.

All our accounts are already over the value where the cap is kicking in. For example, Hargreaves Lansdown charges 0.45%, capped at £45 p.a.3 while AJ Bell charges 0.25% capped at £42 p.a.4 (as long as you don’t hold funds). That’s just £45 and £42 respectively fixed, as far as we’re concerned.

All told, our annual platform costs range from £0 (XO, IWeb) to a couple of hundred pounds (at Interactive Investor – but that’s for an ISA and SIPP) per platform, per person.

I don’t have anything else to add on this subject beyond what you’ll find over at the Monevator comparison table.

Does your investment platform charge extra for funds?

Perhaps because the regulator banned kick-backs from the fund managers to the platforms, some of the latter seem to have decided it’s okay to replace the revenue by charging customers higher fees for funds.

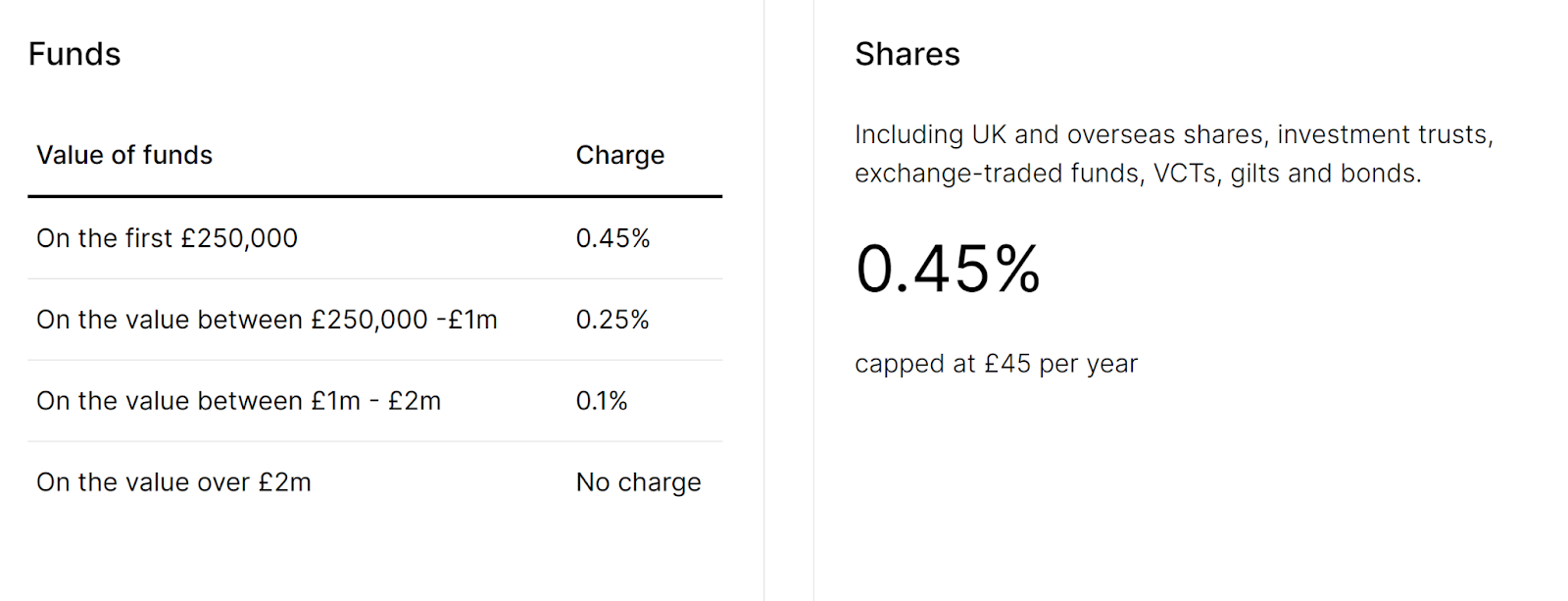

Here’s HL, for example:

Source: Hargreaves Lansdown

Right… Owning £2m of an ETF costs me £45 a year, but owning £2m of the same fund in an OEIC (Open-Ended Investment Company) costs me £4,000 a year.

What extra work is Hargreaves Lansdown doing to earn that £4,000? Absolutely nothing as far as I can tell – as evidenced by the fact that platforms like IWeb and Interactive Investor charge zero to hold that same fund.

Source: Dilbert

Because we don’t really believe in active management and there are equivalent-cost ETFs for nearly everything we want, we only own one OEIC type fund.

And – duh – obviously we hold it across the investment platforms that don’t charge extra for it.

Note that none of the above applies to ETFs. Even though they have ‘fund’ in the name, ETFs are treated as stocks on platforms that charge high fees for funds.

Dealing costs

We don’t trade particularly frequently, so we’re not very sensitive to dealing costs.

That said, Hargreaves Lansdown charging £12 a deal doesn’t feel very 2024 to be honest.

The £5 that IWeb charges seems more reasonable. It’s notable too that AJ Bell is reducing its dealing fees from £10 to £5 in April 2024.

Again, see the Monevator comparison table to stay across all this.

Foreign exchange (FX) fees

If you’re not careful, FX fees can really cost you.

Here’s IWeb on the subject:

Source: IWeb

The example on IWeb’s website features a notably sub-sized £1,000 trade. Perhaps because 1.5% on a more sensible £5,000 – £75 versus £15 – would seem like quite a lot?

A shame, because IWeb is such good value on every other vector.

To illustrate how much of a problem high FX fees can be, let’s switch £100,000 worth of Microsoft stock into Apple. A trade which – given the liquidity of US markets – you’d expect to cost a few basis points.

Here’s the deal:

Generously, the platform doesn’t charge commission. So the switch will cost me a mere £2,977 – or 298 bps of the notional.

Maybe let’s not bother doing the trade after all, eh?

Costly foreign adventures

There are two problems with high costs for foreign exchange.

One is when the FX fees are high, obviously.

The other is when you have to settle everything into GBP5. Our example switch above saw two rounds of FX pain, because we can only hold GBP cash in the account.

Now, in the case of ISAs, this is not the platforms’s fault. It’s what the ISA rules mandate.

But still, a platform doesn’t have to charge an FX spread you could drive a bus through.

In contrast, here’s the FX fee over at Interactive Brokers:

Source: Interactive Brokers

Interactive Brokers is a full 50 times cheaper than IWeb when it comes to FX fees.

Let’s math out that same switch in an Interactive Brokers ISA:

The trade costs us £63 (6.3 bps). Quite a lot less than £2,977.

Naturally, it’s still not good enough for me though. What I really want to do is keep the proceeds in the base currency of the instrument traded, usually USD6. That way I don’t need to pay any FX fees when I switch between assets in the same currency. Why should I?

Outside of an ISA you can do exactly this with several platforms. But a grand total of two brokers in my list enable you to do this in a SIPP: Interactive Investor and Interactive Brokers.

Here are the current cash balances in my Interactive Investor SIPP:

See all those lovely hard currencies?

It’s something of a happy coincidence, because US stocks are best held in a SIPP. So this way you do not have to pay any dividend withholding tax on your US dividends, at least not with sensible platforms.

(In theory the withholding tax exemption should also apply to Canadian stocks. In practice it doesn’t.)

Both Hargreaves Lansdown and AJ Bell are big behemoths. They have the wherewithal to support multiple currency balances and settle trades in the instrument’s underlying currency within their SIPPs.

Yet they choose not to. I can’t imagine why?

Source: Hargreaves Lansdown

And for completeness:

Source: AJ Bell

Whose money is it anyway?

One way to avoid sneaky FX fees is to only buy ETFs for overseas exposure, and to always buy the GBP share class.

This way, your FX exchange happens inside the ETF wrapper at a much better rate / lower spread.

Since the underlying currency of most ETFs is naturally not Sterling, you should buy the Accumulation units to further reduce FX friction. Otherwise your dividends will be paid out in USD, which will then be FX-d into GBP at the platform’s spread and so bleed out another few bps of cost.

For instance, let’s say we wanted to track the MSCI World. We could buy the iShares Core MSCI World UCITS ETF USD (Acc) – whose base currency is USD – and specifically the GBP share class to avoid egregious FX fees:

Source: JustETF

Beware: a cunning trick sometimes deployed by platforms is to act like the GBP share class doesn’t exist.

You look up the ETF in its interface, you’ll only find the USD share class.

And when you complain, it’ll give you some blather about liquidity, or tell you that it “can only carry one share class of each ETF” – presumably because some numpty decided to use ISIN as the Primary Key in the investment platform’s product database.

Cock-up or conspiracy, limiting choice like this leaves you paying the platform’s FX fees.

Investment platform says “no”

Which instruments each platform allows you to trade and under what circumstances is both highly variable between platforms, inconsistent across time, and hard to predict in advance.

Something you bought yesterday, for example, might not be available to buy today. Likewise, something that was previously not deemed ‘complex’ now is. This changeability can make rebalancing very messy.

Let’s say you own some Blackstone Loan Financing (Ticker: BGLP.L) in your IWeb ISA, and you want to buy some more with the spare cash in there.

Bad luck:

Source: IWeb

Now what do you do? Well, you could sell a different stock in another ISA on another platform and buy back that same stock on IWeb. This way you free up cash in the other ISA to buy more BGLP with – but at the cost of you paying two lots of transaction costs and slippage en-route.

In theory you could transfer the cash from IWeb to the other platform, while sending the other stock across to IWeb (perhaps if you were worried about overall platform exposure). But in practice this takes weeks and can cost money so it is not really an option.

Rule changes can also leave you in a weird situation where you own this stock, but if you sell it, you won’t be allowed to buy it again – creating a random hysteresis function in your rebalancing decisions.

Low no-go

Arbitrary restrictions abound in the weeds on the investment platforms.

Another common one is to simply not support the lowest cost ETFs in a category.

Want to increase your Japan weighting a little? A fairly normal process would be to go to JustETF, filter by ‘Japan’, sort by TER, and then buy the cheapest one:

Trackers gonna track, so the ETF we want is clearly the cheapest 5bps one from Amundi. Yet most brokers don’t carry it, and if I ask them to add it they won’t.

Hence I end up paying nearly twice as much (9bps) for the Xtrackers’ one.

Call me old-fashioned, but at the very least anyone who holds themselves out as any sort of stockbroker ought to offer dealing in any London listed security, at a bare minimum.

Another difficult area is leveraged ETFs, which many platforms just won’t go near.

And all this is before we even get to the shit show that are the regulations around Packaged Retail and Insurance-based Investment Products (PRIIPs):

Source: AJ Bell

The KIIDs are not alright

In short, PRIIPs is an EU rule that says you can’t buy US-listed ETFs.

We might have left the EU but – completely unsurprisingly – the one single EU rule that was a personal inconvenience to me has not been repealed, and hence most UK investors still can’t buy US listed ETFs.

This is a shame, because for US markets, US-listed ETFs are cheaper, better, more innovative, and (if held in a SIPP) highly tax-efficient.

In theory, if you are a high-net worth or professional investor you can opt out of PRIIPs and then be allowed to buy US-listed ETFs. This is your ‘MiFID status’ in the parlance.

In practice, the only broker that actually enables this is Interactive Brokers. (IG says it does but, in my experience anyway, it doesn’t work, in that it still won’t let you buy US-listed ETFs, at least not in an ISA).

Because the PRIIPs rules require the platform to have a KIIDs on file for every fund you want to buy this can even hobble buying London-listed stuff, if the broker doesn’t have its systems properly sorted.

There’s also some uncertainty as to what counts as a ‘fund’.

AJ Bell and Interactive Investors enable you to buy completely different sets of US-listed Business Development Corporations (BDCS) because they’ve each made completely different decisions about which ones are funds under PRIIPs.

Which seems a bit… random.

Margin lending

Our Family Investment Company’s account is held at Interactive Brokers. The major advantage of which is very competitive margin lending rates:

Source: Interactive Brokers

Since interest is tax-deductible for a FIC, we concentrate most of our leverage there.

The other brokers don’t support leveraged trading, aside from some white-labeled CFD offering perhaps.

IG obviously has CFD / spread betting. But given its high financing spreads, that’s not really an offering that appeals to me.

Flexible ISA

Why don’t more platforms offer flexible ISAs? IG is the only one (on my list) that does.

As a result I end up carrying higher balances with IG than I would otherwise like to, from a platform risk perspective.

Pet peeve #1: Interactive Investor

It’s a small thing, but a special groan for Interactive Investor for not being able to take SIPP platform charges directly from your SIPP, but rather making you pay them separately from your bank account.

Doing so likely increases your effective post-tax platform cost by between 25-67%, because you’re paying fees from outside the SIPP with post-tax money, rather than from inside with pre-tax money.

I’ve complained to the platform several times. Maybe some of you could complain too? It would cost Interactive Investor nothing and it would save us all a few quid from the tax man.

Pet peeve #2: Interactive Brokers

I have a bit of a soft spot for Interactive Brokers. It is great value and I have a SIPP, ISA, General Investment account and the FIC account over there.

The platform stands out for offering MIFID professional status, low FX fees, multi-currency accounts, and being able to trade Options (long-only in the SIPP) and futures (in a general trading account).

However, it is not all sweetness and light.

To start with, Interactive Brokers’ interface is something only a grizzled institutional equities trader from the 1990s could love. Your Nan won’t be using it to buy a few hundred shares of M&S. The learning curve is steep.

The other thing to note – for people who trade UK stocks – is that Interactive Brokers doesn’t have any Retail Service Providers (RSPs).

RSPs are the institutional traders who get you those ‘inside the spread’ and ‘price improvement’ prices that you see with other platforms.

Interactive Brokers basically only offers Direct Market Access (DMA). If you trade UK stocks, particularly mid caps, this may be a problem for you.

My overall view of the investment platforms

Source: Finumus ‘Vibes’, based on personal experience.

Right, let us know what you think in the comments below. And do check out the fine print in the Monevator broker comparison table for more on each platform.

If you enjoyed this, you can follow Finumus on Twitter or read his other articles for Monevator.

AKA ‘Seg’.Assets Under Management.Cap is £45 for an ISA, £0 for a trading account, £200 for a SIPP.£120 fee cap for a SIPP.UK pounds.US dollars.

The post Which investment platform do I use and why? appeared first on Monevator.